Hello everyone! I thought I'd join this community to connect with like-minded people, build genuine connection, and hopefully get motivation to keep going on this debt free journey.

A bit about myself, I'm a thirty-something-year-old woman living in Alaska with her husband who's in the ARMY and 3 children (16yo girl, 13yo girl, and 4yo boy). I'm a Dave Ramsey enthusiast although I do disagree with some of his teachings (for example, saving $1,000 for emergency fund). My hobbies include photography, working on my planner, and making excel budgeting sheets.

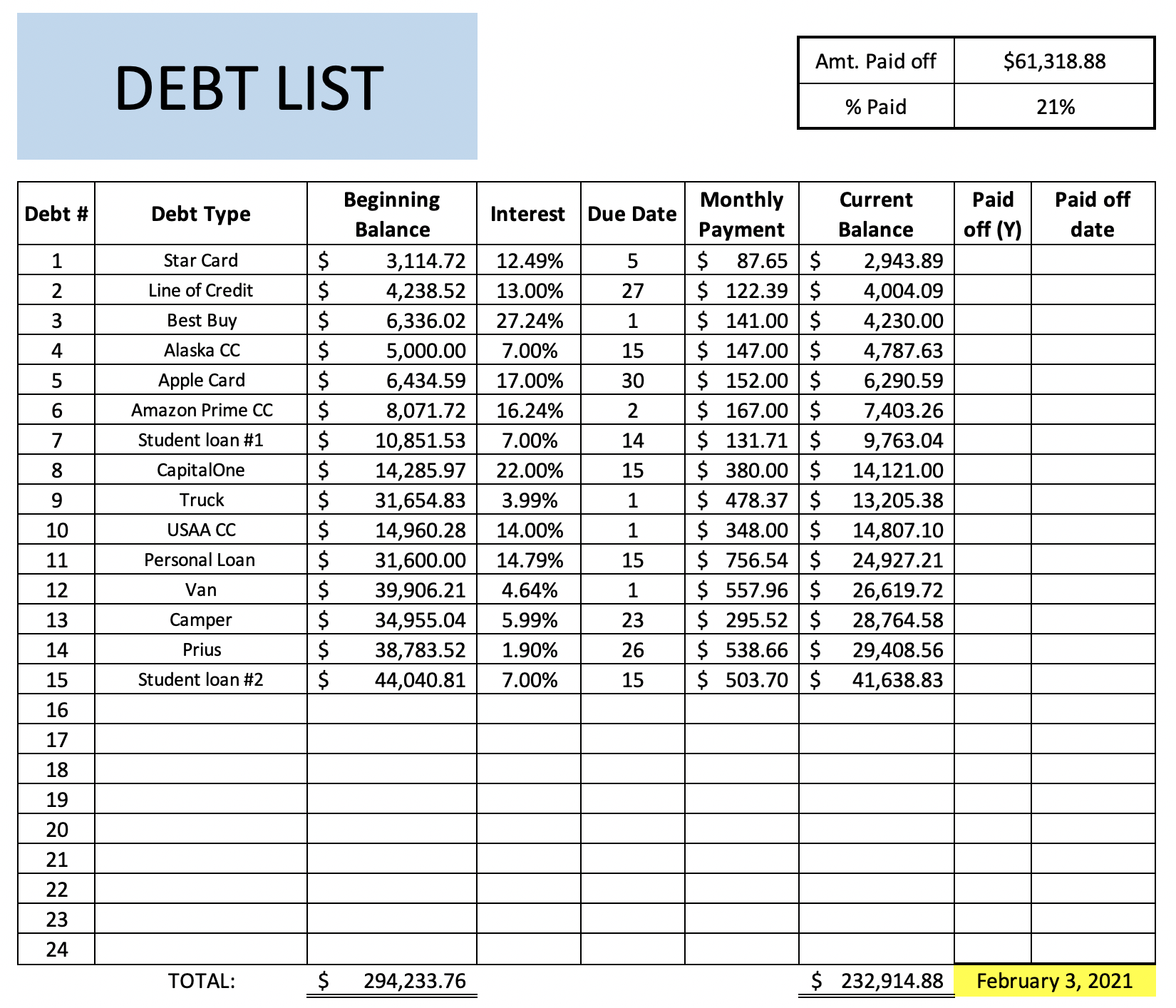

Anyway, I was curious. Is there anyone here other than me that has a six figure debt amount? If so, how do you plan on tackling the debt?

February 6th, 2021 at 06:59 am 1612594769

If you don't get a lot of comments today, it is because of the site having issues with their security certificate. Usually a bunch of people will jump in to welcome newbies, so don't be discouraged if no one else responds until they fix it. I just know how to circumvent the security issue and post anyway.

February 6th, 2021 at 11:27 pm 1612654039

Personally not six figures. We did owe close to $80k on DH's student loans MBA and we have had car loans intermittently. We also have a very currently large mortgage.

February 7th, 2021 at 03:17 pm 1612711058

February 7th, 2021 at 04:50 pm 1612716609

I love my Excel spreadsheets & Clever Fox budget planner. I’ve turned into a huge budgeting enthusiast!

Have you ever called into the Dave Ramsey show?

February 7th, 2021 at 04:56 pm 1612716993

I don’t know what your income is, but I notice you have four vehicle loans - Prius, van, camper, Truck.

That accounts for almost half your debt. Any chance you can sell some of these to get a head start?

Is there anything you bought with the credit cards that you can sell?

Understanding what you are charging is important for you - if it’s food or medical, you have a different issue than if it’s entertainment or impulse purchases.

Would you like to post a budget? I wonder if you are able to sustain living expenses and this debt on your income.

If you have federal student loans where interest is suspended, I would direct that to higher interest debt. Hopefully, some student loan debt will be forgiven!

If nothing else, if you are eligible for the stimulus payment, I would target the Best Buy and potentially the Capitol One Debt as they are your highest interest rates. You might be able to eliminate Best Buy to get a snowball.

February 7th, 2021 at 05:04 pm 1612717490

February 7th, 2021 at 09:31 pm 1612733486

The blogs are great but I'd also recommend you post to the forums, especially if you're going to post more details like your budget and income info. It's easier to reply to individual comments there so it makes for a much more organized discussion.

It's fantastic that you've paid off 21% of your debt so far. How long has that taken?

In order to give meaningful advice and suggestions, we really need to see the income and spending info so I look forward to you posting that.

I'll withhold any other comments until I see the numbers.

Thank you and your husband for your service.

February 7th, 2021 at 09:34 pm 1612733641

February 7th, 2021 at 09:53 pm 1612734829

The low interest debt seems to have decreased by a lot more than the high interest debt, but that could just be a timing issue. For example, the truck loan (3.99%) has dropped by $18,000, but the BestBuy balance (27.24% - ouch) has only dropped by $2,000.

Make sure that you are putting every spare penny toward the debt with the highest interest rate and just paying the minimums on everything else. That's the system that will get you out of debt the fastest and save you the most money. I know Dave Ramsey says to focus on the smallest balance first, but it doesn't look like you've been doing that either.

February 7th, 2021 at 11:03 pm 1612739000

Welcome to Saving Advice.

Don't be afraid to use balance transfer cards, just make sure that the math works in your favor with any balance transfer fees. A lot of people think that these offers include deferred interest, but they do not. When the promotional period ends, the regular rate is applied from that point forward. In the interim, if you have reduced your debt significantly, you are that much further ahead. If you can transfer the balance on one card to another with more favorable terms, feel free to close and cancel the original card. That way, there is zero chance that the balance will be run up again.

I see that you are planning to live in a camper; my SO and I live in a 5th wheel. I am getting close to paying off the debt on it and am so very excited about that. May I ask about your current living situation? Do you own a home you plan to sell, are you renting, etc.

And finally...how is it you were able to add a picture? I have been trying for MONTHS to add pictures to my blog and cannot. If you would like to email me directly instead of answering here, please feel free.

Best of luck to you with your goals. I am looking forward to following your progress.

February 8th, 2021 at 12:02 am 1612742569

Welcome to SA. We never had that kind of debt, but we never made a whole bunch of money either. Lots of good ideas, advice, and camaraderie here.

February 8th, 2021 at 05:18 am 1612761485

February 8th, 2021 at 05:23 am 1612761830

February 8th, 2021 at 06:29 am 1612765743

February 8th, 2021 at 02:32 pm 1612794735

This is priority #1! You will never make any progress if you don't fix this. The first rule when you find yourself in a hole is to stop digging.

You need to sit down with him and review the situation and the numbers. Show him how much is coming in and how much is going out.

Your monthly debt payments come to $58,000/year. I don't know how much you earn but I'm guessing that's a big chunk of your income. He needs to understand that he can't keep spending money you don't have to buy things you don't need.

February 8th, 2021 at 06:15 pm 1612808151

Also for the minivan? Is it new or used? Buy a 5 year old used van and drive it for 5 years and I bet if you get an american brand you can get it for like $10k. That'll save you $30k in debt.

I personally have a used van 2015 Toyota Sienna bought in 2017. Paid $28k for it fully loaded with leather and dvd player. So sell your minivan and get an older used one. I bet you could get a toyota that's 5 years old for like $15k. It'll run forever.

February 8th, 2021 at 10:19 pm 1612822754

February 9th, 2021 at 12:12 am 1612829561

February 9th, 2021 at 01:29 am 1612834142

We have several accounts for what we need, so we have an everyday acct, an ice acct (emergency), a POm acct (yearly/quarterly bills we put a certain amount each month), we have a medical acct, a car acct (services/tyres/rego/ins etc), our mad money accts and an acct for our house deposit...this is our main priority to buy a house. Once we buy a house we will start putting money away for a car again as we pay cash for our cars...we have no debt...and hopefully the only debt we will have again will be a mortgage...

I don't know if you work or anything but any extra money you have some say put on the higest interest rate, but many like paying of the smallest then moving into the next one one...I wish you luck and I would suggest that you include the whole family in the budgeting discussion, it is great for the kids to learn as well...I wish you the best of luck....make a plan..plan some goals and start the journey...In australia we usually use the barefoot investor, he does it for families as well as adults as we do things a bit different here!!

February 9th, 2021 at 01:45 am 1612835146

February 17th, 2021 at 12:12 am 1613520734

February 17th, 2022 at 10:34 pm 1645137271

April 1st, 2022 at 02:21 am 1648779675

I think you are very cool for posting finances and seeking resolutions to your debt.

I do not know the whole situation but do you own a home. If so I was also in 16k credit card debt and 12k on a car loan. I refinanced my house and paid off all these loans with cash out from refinance which brought my debt to 3.5 interest rate and I think it really improved our situation.

Also I planned a date with my husband and we had sort of a business meeting about finances where we both agreed to save 2k a month in a savings account which has been working very well just by making the time and intention to do it.

Best of luck with it and things can change quickly sometimes